Home Tags Posts tagged with "uk economy"

uk economy

The UK economy is set to grow by around 0.5 percent before the end of 2014, according to a recent survey. Even though this figure is less than what was forecast earlier this year, it represents the worst case scenario. The most optimistic prediction is a rise of 0.8 percent. Despite the future being uncertain, some believe the British economy is still growing at a faster rate than its counterparts around the globe.

Startups on the rise

Regardless of whether there is an economic recovery or rescission, it is always a risk to start up a new business. For the moment, however, the outlook for small businesses seems positive. More and more people are choosing to leave large corporations and set up businesses of their own. A survey recently found that 65 percent of people working in a corporate environment would rather be working for a small startup company. People are attracted to the idea of starting their own business because it could mean making their dream job a reality. It could also give people more control over their work, and the freedom to create their own rules and regulations. On the other hand, working for a large corporation is sometimes viewed as political and bureaucratic. Some people may feel that they are not respected within the organisation and are not given sufficient training or opportunities to progress.

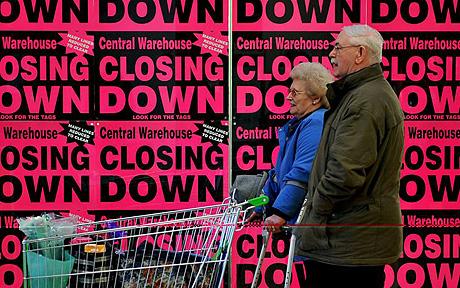

Image from Flickr

Government initiatives

The UK Government seems to be taking notice of this development and facilitating this change in various ways.

Lord Young’s third and final report on enterprise was published in June 2014 and focuses on encouraging enterprise in education. Of particular significance, Lord Young recommends the introduction of an ‘enterprise passport’. This passport will act as a digital record of all enterprise-related activity that a child has taken part in during their time in education. This move will allow young people to learn business techniques at an early stage in life and allow them to develop important employment skills.

There many UK Government schemes available that help new and emerging businesses. The growth vouchers scheme helps small enterprises get strategic advice on finance, marketing and hiring and training staff. The decrease in corporation tax and the removal of restrictions on starting a business from home, will also benefit small businesses.

Startup businesses that don’t qualify for government funding can apply for a bank loan. Or, new businesses may wish to try the popular method of crowdfunding to cover the initial costs of setting up. Crowdfunding involves gathering monetary contributions from a large amount of people. Additional funds can be raised by selling shares in the new business. There are plenty of funding options available and several online resources which help startup businesses find the right finance package.

Recommendations for new businesses

Budding entrepreneurs are encouraged to find mentors in the business world who can impart wisdom and provide advice. This is known as radical mentoring, where mentors provide guidance, feedback, and support to entrepreneurs. Having a radical mentoring expert by their side means that entrepreneurs can learn from the mistakes of others and avoid costly errors. Mentors can also provide insight into the best practices to follow when running a business, and they can offer valuable advice on how to best structure the organization. There are a number of services available that link up new businesses with business mentoring organisations. Mentors provide advice on dealing with difficult situations and give guidance on developing and improving the business.

Market research is an essential element to launching a new enterprise. It is important to test any new products or services before selling them. Market research also allows a new business to receive feedback from potential customers. It is important to pay close attention to negative feedback and think about whether alterations to the product or service should be made. Researching the market also allows new businesses to identify and analyse competitors.

New enterprises should start with a solid business plan. The development of a comprehensive plan is an essential step in order to set out the finer details, set goals and address any problems at an early stage. The plan will include a summary of the business, finance information and market research. It will also include details of competitors, as well as sales and marketing information. Business plan templates are available online to download from various sources. Businesses will need to present their plan to banks, potential investors and partners, so it is important that it is complete and professional.

Experienced entrepreneurs recommend that every emerging business should have a website. Establishing an online presence is an essential way to spread the message about the goods and services that the enterprise provides. It is also important to use social media to reach out to potential customers and to other businesses. Commercial organisations are not only using social media to connect with customers, they are also using it to give their company personality. Images and videos are used to portray a more friendly, approachable organisation. Social media channels are also being used by businesses to provide customers with exclusive information and deals.

It is also recommended that new businesses invest money in upskilling their staff. Even if the company employs a small number of people, this is still an important step. Providing regular training for your staff will ensure the business is kept up to date. Training will also keep staff motivated. Many businesses are now also offering their staff training in areas that are not directly relevant to their role, in order to boost morale.

Startup companies should organize an opening event and hire a professional speaker to promote the business. Depending on the state of the company, this speaker could be used to motivate new employees or attract potential clients. If the speaker is being used to motivate employees, bringing in one of the top sales motivational speakers in the world makes sense because it can help these employees to hit the ground running. Having a well-known and reputable speaker associated with the company immediately adds credibility to the organization and that alone can generate sales as the business attempts to grow.

New businesses are advised to think carefully about the right office space. It is not likely that a new business will want to be locked into a lengthy lease. The company may increase in size before the lease is up and so more suitable accommodation may be required. Businesses should consider the rent and running costs of the premises. It may be possible to find office space in Leeds available for rent at a reasonable price, as well as elsewhere in the UK. New businesses should also consider the type of space the business needs and what amenities are necessary.

It is recommended that entrepreneurs work out what legal structure fits their business. The company may be set up as a sole trader, limited company or partnership. Each model comes with its own advantages and disadvantages. This decision should be made before registering for tax and trading.

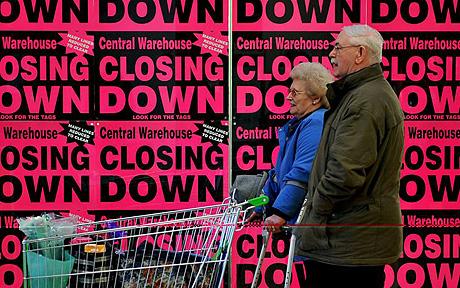

The UK has lost its top AAA credit rating for the first time since 1978 on expectations that growth will “remain sluggish over the next few years”.

Moody’s became the first ratings agency to cut the UK from its highest rating, to Aa1.

It said the UK government’s debt reduction programme faced significant “challenges” ahead.

Chancellor George Osborne said the decision was “a stark reminder of the debt problems facing our country”.

“Far from weakening our resolve to deliver our economic recovery plan, this decision redoubles it,” he added.

“We will go on delivering the plan that has cut the deficit by a quarter.”

The UK has had a top AAA credit rating since 1978 from both Moody’s and S&P.

Shadow chancellor Ed Balls said the decision was a “humiliating blow to a prime minister and chancellor who said keeping our AAA rating was the test of their economic and political credibility”.

In announcing the ratings cut, Moody’s cited the “challenges that subdued medium-term growth prospects pose to the government’s fiscal consolidation programme, which will now extend well into the next parliament”.

It added that the UK’s huge debts were unlikely to reverse until 2016.

“The main driver underpinning Moody’s decision to downgrade the UK’s government bond rating to AA1 is the increasing clarity that, despite considerable structural economic strengths, the UK’s economic growth will remain sluggish over the next few years due to the anticipated slow growth of the global economy and the drag on the UK economy,” Moody’s said.

But it added that the outlook for the UK is “stable”, meaning it sees no further downgrades in the near future, and added “the UK’s creditworthiness remains extremely high”.

It will massively increase the pressure on George Osborne, from both those who want him to raise taxes and cut spending further and from those who want him to alter course in next month’s Budget and spend more to try to boost growth.

The UK has lost its top AAA credit rating for the first time since 1978 on expectations that growth will remain sluggish over the next few years

The UK’s net sovereign debt was the equivalent of 68% of the country’s annual economic output, or GDP, at the end of last year.

“The very fact that we didn’t see this downgrade happen in the past few years is a testament to the UK’s credibility,” said Lena Komileva, an economist at G+ Economics.

“There are no magic fixes for this kind of problem. It’s not a question of what the government is willing to do, it is what it can do.”

All three major credit agencies last year put the UK on “negative outlook”, meaning they could downgrade its rating if performance deteriorates.

In his Autumn Statement in December, George Osborne acknowledged public finances were taking longer to rectify than planned, and admitted he would be forced to extend austerity measures by at least another year.

Germany and Canada are the only major economies to currently have a top AAA rating – as much of the world has been shaken by the financial crisis of 2008 and its subsequent debt crises.

A downgrade of a credit rating does not necessarily substantially damage the ability to borrow.

The US – the world’s biggest economy – was downgraded from its AAA rating last year, a move that has not materially changed its borrowing costs.

Moody’s removed France’s AAA rating in November.

The UK has experienced a double-dip recession since 2008. It grew in the third quarter of last year – boosted by the impact of the Olympics, but shrunk again by 0.3% in the last three months of 2012.

Earlier this month, the Organization for Economic Co-operation and Development said the Bank of England should be ready to inject more money into the economy to boost growth.

The Bank has so far pumped £375 billion into the financial system, creating money to buy-back government bonds.

The credibility of ratings agencies have also come under attack. S&P is being sued by the US government over ratings it gave to some mortgage-backed assets in the run-up to the global financial crisis in 2007, which subsequently fell dramatically in value.

Moody’s announcement sent the pound falling further in value, but financial analysts said the impact was likely to be limited because the markets had been expecting a downgrade for some time.

[youtube Ant27tSEzs0]

The Office for National Statistics in UK has announced that the country’s economy has returned to recession, after shrinking by 0.2% in the first three months of 2012.

A sharp fall in construction output was behind the surprise contraction, the Office for National Statistics (ONS) said.

A recession is defined as two consecutive quarters of contraction. The economy shrank by 0.3% in the fourth quarter of 2011.

Wednesday’s figure is an early estimate and is subject to at least two further revisions in the coming months. It is compiled using 40% of the data gathered for later revisions.

The UK economy was last in recession in 2009.

Prime Minister David Cameron said the figures were “very, very disappointing”.

“I don’t seek to excuse them, I don’t seek to try to explain them away,” he said at Prime Minister’s Questions.

“There is no complacency at all in this government in dealing with what is a very tough situation, which frankly has just got tougher.”

David Cameron said it was “painstaking, difficult” work, but the government would stick with its plans and do “everything we can” to generate growth.

Labour leader Ed Miliband said the figures were “catastrophic” and asked David Cameron what his excuse was.

“This is a recession made by him and the chancellor in Downing Street. It is his catastrophic economic policy that has landed us back in recession,” Ed Miliband said.

UK economy returns to recession after three years

The ONS said output of the production industries decreased by 0.4%, construction decreased by 3%. Output of the services sector, which includes retail, increased by 0.1%, after falling a month earlier.

It added that a fall in government spending had contributed to the particularly large fall in the construction sector.

“The huge cuts to public spending – 25% in public sector housing and 24% in public non-housing and with a further 10% cuts to both anticipated for 2013 – have left a hole too big for other sectors to fill,” said Judy Lowe, deputy chairman of industry body CITB-ConstructionSkills, said.

Some have questioned the validity of the ONS’s figures, particularly on the construction industry, which has been particularly volatile in recent quarters.

But Joe Grice, chief economic adviser to the ONS, said the construction data was based on a survey of 8,000 companies and had been carefully checked and double checked.

The latest figures supported the view that the economy had been “flattish” in the past few quarters, he added.

Over the last year and a half, the economy has fluctuated between quarters of growth and contraction.

Bank of England governor Sir Mervyn King has previously warned that the economy will continue to “zig zag” this year.

He had forecast growth in the first quarter but then a contraction in the second quarter, when the extra bank holiday for the Queen’s Diamond Jubilee is expected to reduce output.

“It is clearly not good news, the missing link in the economy has been confidence,” said Graeme Leach, chief economist at the Institute of Directors.

“These are relatively small falls, so we shouldn’t be too alarmist.

“[But] regardless of the figures, it is the message that comes out to business – to be cautious – exactly when we want them to be a little more aggressive in terms of recruitment and investment.”

However, some pointed to other recent business surveys, which painted a more positive picture of the economy.

“These figures are at odds with the experiences of many UK businesses, which continue to operate with guarded optimism,” said David Kern, chief economist at the British Chambers of Commerce.

He added that he expected the preliminary estimate to be revised upwards when more information became available.

The estimate for construction output is based on published data for the first two months of the quarter, and an estimation for the third month.

But the ONS pointed out that, while there was “a tendency for upward revisions” to construction, March would need to be “exceptionally strong” in the construction sector to produce growth in the quarter.

The first estimate of GDP for the last three months of 2011 showed a contraction of 0.2%, which was later revised to a contraction of 0.3%.

[youtube -ugoxa_e_Lk]