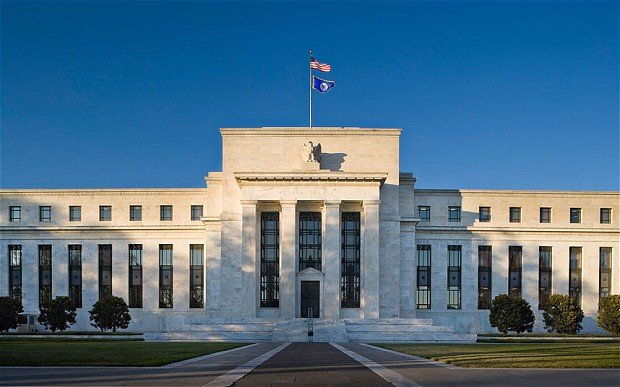

Minutes of the Federal Reserve’s July meeting revealed few clues about the central bank’s timeline for unwinding its extraordinary efforts to support the US economy.

Officials said they were “broadly comfortable” with plans to scale back the Fed’s $85 billion a month bond-buying programme.

However, the timing remains murky.

Almost all agreed a change in the programme was “not yet appropriate” but “a few” favored swift action.

Fed officials said that recent economic data had been “mixed”, which could indicate that plans to begin the so-called “taper” might be put off if the economy were to weaken.

The central bankers will reconvene on September 17 for a two-day meeting, which will be followed by a press conference by chairman Ben Bernanke.

Minutes of the Federal Reserve’s July meeting revealed few clues about the central bank’s timeline for unwinding its extraordinary efforts to support the US economy

The Dow tumbled by more than 100 points after the minutes were released, although quickly recovered. The S&P 500 and Nasdaq also fell briefly.

After Ben Bernanke hinted at plans to end the bank’s accommodating monetary policy in June, mortgage rates jumped sharply, threatening a fragile housing recovery.

Fed officials acknowledged that market reaction to discussion of an easing of expansionary monetary policy has been volatile.

“Meeting participants pointed to heightened financial market uncertainty about the path of monetary policy and a shift of market expectations toward less policy accommodation,” according to the minutes.

The September Federal Open Market Committee meeting will occur after a spate of economic data has been released, including another jobs report as well as revised second-quarter GDP estimates.

Officials hope this new data will help give them a better sense of when tapering should begin, which many investors believe will happen sometime before the end of this year.

Ben Bernanke has indicated that the timing of the Fed’s decision will be dependent on a healthy US economy.

[youtube ESi29VGDZOM]

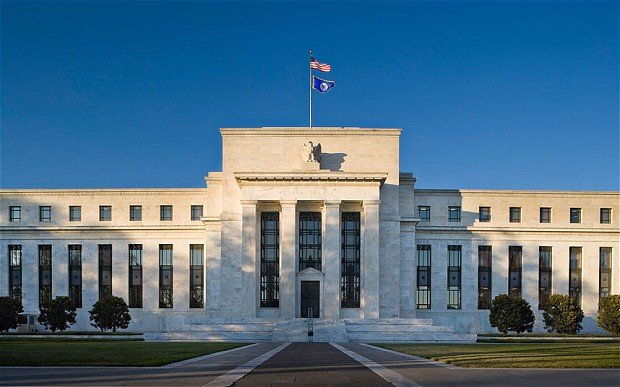

Global markets have fallen sharply after the Federal Reserve signaled it may begin to scale back its stimulus of the US economy later this year.

European stock markets were down 3% or more by the close, as US markets fell a further 1.5% at their open.

Other risky investments, such as bonds and commodities also fell, with short-term cash offering the only safe haven.

The dollar rose as markets anticipated US interest rates rising sooner than had been thought, while the yen fell.

The markets were spooked after Fed chairman Ben Bernanke said that if the central bank’s forecasts were correct, it could begin slowing down its “quantitative easing” programme of asset purchases by the end of 2013, and wind them down completely by the middle of 2014.

The end of the asset purchase programme would mark a return to the use of interest rates as the monetary policy weapon of choice.

The Fed has been buying bonds at a rate of $85 billion a month, but believes it may be able to scale this back as the US economy recovers and end the programme next year.

The Fed has kept short-term interest rates in a range between zero and 0.25% since December 2008.

Although they are expected to remain close to zero for at least a couple more years, Ben Bernanke’s comments raised market expectations that the short-term cost of borrowing would rise sooner than had previously been thought.

Ben Bernanke emphasized that the programme was tied to how well the US economy, and in particular the US jobs market, was doing.

However, his comments led to a widespread equity sell-off in the US late on Wednesday, with US markets down 1%.

The rest of the world followed suit on Thursday, with the market slide gaining momentum, with US markets falling further after they reopened.

The latest market sell-off continues a steady decline in share prices worldwide over the last month.

It repeats similar market sell-offs at the same point in the interest rate cycle in 2003 and in 1993-94 when investors started to anticipate a return to interest rate rises.

The expectation of rising interest rates also infected bond markets, which normally provide a safe haven from falls in the stock market.

Global markets have fallen sharply after the Federal Reserve signaled it may begin to scale back its stimulus of the US economy

The 10-year US Treasury bond fell sharply in price on Wednesday, causing its yield – the yearly return earned by investors and the implied cost of borrowing of the US government – to rise from 2.19% to 2.35%. On Thursday morning, the rate crept higher to 2.38%.

Borrowing costs also rose in other countries – particularly for debtors deemed by markets to be riskier, including recession-hit southern European countries such as Spain and Italy.

Even the yield on super-safe German government bonds edged higher, in part due to the widely perceived unwillingness of the European Central Bank to cut eurozone interest rates.

Investors have also been rattled by events in China, where the country’s economy appears to be slowing sharply, and its banking system is experiencing severe stress as the Chinese central bank seeks to rein in what the authorities increasingly see as the excessive and opaque lending of recent years.

With the central bank unwilling to make cheap loans easily available, the interest rate at which Chinese banks were willing to lend to each other overnight jumped to an unprecedented annualised 30% on Thursday.

The double-digit, reminiscent of the 2008 Western financial crisis, may imply a collapse of confidence in the interbank market as well as an unwillingness of the central bank to accommodate the banks.

There are widespread fears that the state-owned banks may be facing heavy losses on the glut of loans they rushed out over the last five years in order to keep the Chinese economy afloat despite the stagnation of its main Western export markets.

Evidence that both the US and Chinese central banks were taking their foot off the economic accelerator also depressed global commodities market.

China is the dominant consumer of many of the world’s raw materials, particularly industrial metals, iron ore and other materials used in its construction boom.

The price of copper futures – a bellwether of Chinese demand – fell 2.4% and threatened to break through lows set in April.

The prospect of higher interest rates in US dollars also translated into a stronger US currency.

All major currencies fell against the dollar, as did the price of precious metals.

Gold resumed its rout of recent months, dropping another 6% on Thursday. It is now down 28% since the apparent bubble in the metal burst in October.

The price of silver – the more volatile of the two – fell 6.4%.

The metals have proved popular among investors who fear that the Fed’s money printing would eventually result in sharply rising prices – something that has as yet failed to materialize.

However, they failed to enjoy their traditional safe haven role in the current market turbulence – a role that has instead been usurped by US dollar cash.

[youtube UH-l_RFwpxs]

Apple shares dropped below the $400 mark for the first time since December 2011 amid concerns over slowing sales.

Apple shares fell as low as $398.11 in Wednesday trading, before ending the day down 5.5% at $402.80.

The concerns were triggered after one of its suppliers, Cirrus Logic, which makes sound components for the iPhone and iPad, reported a decline in sales.

With Apple due to release its latest quarterly results next week, some fear the numbers may be underwhelming.

According to various estimates, demand from Apple accounts for nearly 90% of Cirrus’s revenue.

Apple shares dropped below the $400 mark for the first time since December 2011 amid concerns over slowing sales

Michael Yoshikami, a portfolio manager at Destination Wealth Management, said that Cirrus’s warning makes it more likely that “Apple’s not going to surprise on upside”.

Apple, which enjoyed tremendous success in recent years, has been facing increasing pressure lately, both from rivals as well as investors.

While the sales of its popular iPhone and iPad have grown – they have fallen short of market expectations – and its market share has been declining.

At the same time, Apple’s biggest rival Samsung has been steadily increasing its market share, both in the smartphone and tablet PC sectors.

According to research by Gartner, in the final quarter of 2012 Samsung sold 64.5 million smartphones to Apple’s 43.5 million.

Samsung also doubled its share of the tablet PC market to 15.1% in the last three months of 2012, while Apple saw its share slide to 43.6% from 51.7%, despite seeing a jump in sales, data released by IDC earlier this year showed.

At the same time, some analysts have also been disappointed over the delay in launch of new products by the company.

There are rumors that the release of the company’s next iPhone may not be until September, rather than in June as had been earlier expected.

To add to its woes, a brand survey released by consultancy Added Value in March showed that Apple is perceived as less “inspiring” than it was three years ago.

Meanwhile, Samsung is now seen as equally inspiring in the US.

That has led many investors to fear that Apple may be losing its dominance and as a result its revenues and profits may be hurt.

All these concerns have seen investors ditch Apple’s stock. Its shares have fallen more than 40% since hitting their peak in September 2012.

[youtube 9-r88MXCZVU]