Home Tags Posts tagged with "international monetary fund"

international monetary fund

Four UN employees and a senior IMF official were among 21 people killed in a suicide bomb and gun attack on Taverna du Liban restaurant in Kabul, officials say.

Wabel Abdallah, the head of the IMF’s Afghanistan office, and the UN civilian staff died in what UN chief Ban Ki-moon said was a “horrific attack”.

Canadians, Lebanese, Britons and Americans were among the 13 foreign victims; the other eight were Afghans.

The Taliban said they carried out the attack late on Friday.

Five women were among the dead at the city’s popular Taverna du Liban, and at least five were injured, police say.

The restaurant in Kabul’s Wazir Akbar Khan area is popular with foreign nationals, diplomats and aid workers, and was busy with diners at the time of the attack.

A suicide attacker detonated his explosives outside the gate of the heavily fortified restaurant, Deputy Interior Minister Mohammad Ayoub Salangi said.

Mohammad Ayoub Salangi said two gunmen then entered the restaurant and started “indiscriminately killing” people inside.

Four UN employees and a senior IMF official were among 21 people killed in a suicide bomb and gun attack on Taverna du Liban restaurant in Kabul

IMF chief Christine Lagarde later confirmed that Wabel Abdallah, 60, a Lebanese national, was among those who died.

“This is tragic news, and we at the fund are all devastated,” Christine Lagarde said in a statement.

Meanwhile, UN Secretary General Ban Ki-moon condemned “in the strongest terms the horrific attack”, his spokesman said.

“Such targeted attacks against civilians are completely unacceptable and are in flagrant breach of international humanitarian law. They must stop immediately,” Ban ki-moon was quoted as saying.

At least two US citizens died in the attack, the US embassy in Kabul said.

Kamal Hamade, the well-known Lebanese owner of the restaurant, and five women were among the dead. A number of people were injured.

“I was sitting with my friends in the kitchen when an explosion happened and smoke filled the kitchen,” Abdul Majid, a chef at the restaurant, told AFP news agency.

“A man came inside shouting and he started shooting. One of my colleagues was shot and fell down. I ran to the roof and threw myself to the neighboring property.”

The attackers were eventually shot dead by the security forces when they arrived at the scene.

[youtube RvUbgd1oL8k 650]

The IMF has cut its forecast for global economic growth at the same time as lifting its UK growth projection.

The International Monetary Fund now expects global growth of 2.9% this year, a cut of 0.3% from July’s estimate. In 2014 it expects global growth of 3.6%, down 0.2%.

It cited weakness in emerging economies for the cut.

The forecast for UK growth this year received a significant upgrade to 1.4%, up from July’s estimate of 0.9%.

And for next year the IMF expects UK growth of 1.9%, up from July’s projection of 1.5%.

The IMF’s upgrades for its outlook on the UK are larger than those it made for any other country in its World Economic Outlook – its twice-yearly assessment of the global economy.

It credited recent data indicating higher consumer and business confidence, for the increase.

However, it warned that it would still take years for the UK economy to recover fully from the 2008 financial crisis. It suggested that the government could help boost growth by bringing forward planned public infrastructure spending, such as building new homes.

The IMF has cut its forecast for global economic growth at the same time as lifting its UK growth projection

The UK Treasury said the IMF upgrade showed the government’s economic strategy was working.

“But risks to the global economy remain high, and the recovery cannot be taken for granted. That is why the government will not let up in implementing its economic plan,” a spokesman added.

Despite the improvement in growth in advanced economies such as the UK and US, the IMF warned that a slower pace of expansion in emerging economies such as Brazil, China and India, was holding back global expansion.

The IMF expects growth in Russia, China, India and Mexico to be slower than it forecast in July.

In part, it says this is due to expectations of a change in policy by US central bank the Federal Reserve. Simply the expectation that the US could trim back its efforts to stimulate the US economy has already had an impact on interest rates in emerging economies, the IMF said.

It said an increasing belief that China’s growth rate would slow would also hit global growth.

The IMF expects the US to drive global growth.

But it warns that the political standoff over raising the US government’s borrowing limit, if it results in the US defaulting on its debt payments, “could seriously damage the global economy”.

The IMF expects growth of 1.6% in the US this year and 2.6% next year, down 0.1% and 0.2% from its July forecast.

In the euro area, the IMF says business confidence indicators suggest activity is close to stabilizing in peripheral economies, such as Italy and Spain, and already recovering in core economies such as Germany.

Overall, it predicts growth will fall 0.4% this year, an improvement of 0.1% on its July prediction, and grow 1% next year.

“In short, the recovery from the crisis continues, albeit too slowly,” said Olivier Blanchard, economic counselor at the IMF.

“The architecture of the financial system is evolving, and its future shape is still unclear. These issues will continue to shape the evolution of the world economy for many years to come.”

The International Monetary Fund has admitted that it made mistakes in handling Greece’s first international bailout.

The IMF said it was too optimistic in its growth assumptions and said a debt restructuring should have been considered earlier.

Greece was granted a 110 billion euro ($145 billion) bailout by the IMF and EU in May 2010.

Another 130 billion euro rescue package was approved in February 2012.

Greece’s first bailout came amid fears the country would default on its debts and that it could spark debt contagion in the eurozone.

The IMF has now released a study looking at the handling of the programme.

It admitted that it bent its own rules on exceptional access for the programme to go ahead.

To justify exceptional access, one of the four criteria that must be met is that public debt is sustainable in the medium term.

But the IMF said: “Even with implementation of agreed policies, uncertainties were so significant that staff were unable to vouch that public debt was sustainable with high probability.”

But staff wanted to go ahead with exceptional access because of fears that any spillovers from Greece would threaten the rest of the eurozone and the global economy.

The IMF then amended the criterion to where debt was not sustainable with high probability, “a high risk of international spillover effects provided an alternative justification”.

The IMF has admitted that it made mistakes in handling Greece’s first international bailout

The IMF described the programme, which ran from May 2010 to March 2012, as a “holding operation” that gave the euro area “time to build a firewall to protect other vulnerable members and averted potentially severe effects on the global economy”.

It said it had notable successes such as achieving strong fiscal consolidation, Greece remaining in the eurozone and any spillovers that might have had a severe impact on the global economy were relatively well-contained.

But it also said there were notable failures, chiefly market confidence was not restored, the banking system lost 30% of its deposits and the Greek economy experienced a much deeper-than-expected recession.

Greece’s economic output (GDP) in 2012 was 17% lower than in 2009, compared with the IMF and EU’s initial projection of a 5.5% decline. The original growth projections were not marked down until the fifth review in December 2011.

The unemployment rate in 2012 was 25%, compared with the original programme projection of 15%.

The IMF added that in future Fund staff should be more skeptical about official data.

The Fund also criticized the delay in restructuring Greece’s massive debt load by forcing private holders of Greek bonds to take losses, which eventually took place in the first half of 2012.

“Not tackling the public debt problem decisively at the outset or early in the programme created uncertainty about the euro area’s capacity to resolve the crisis and likely aggravated the contraction in output,” the report said.

It said an upfront debt restructuring would have been better for Greece but this was “not acceptable to the euro partners”, some of whose banks held large amounts of Greek government debt.

The report also said there was no clear division of labor between the IMF, the EU and the European Central Bank, the so-called “troika”.

It said that while there were “occasional marked differences of view” within the troika, these were generally not on display to the authorities so did not risk slowing negotiations, and noted that “co-ordination seems to have been quite good under the circumstances”.

[youtube QEITf-iM2N4]

IMF has cuts its economic growth forecast for China, with weakness in the global economy set to hit exports.

The International Monetary Fund it now expected the world’s second largest economy to grow by “around 7.75%” this year, and at about the same pace in 2014.

That is lower than the 8% forecast for 2013 the IMF made in its World Economic Outlook, published last month.

The IMF also called for a “decisive impetus to reforms” in the country.

Last year, China’s economy grew by 7.8%, its slowest rate for 13 years. In the first three months of this year, it expanded at a lower-than-expected annual pace of 7.7%.

Last week, the release of disappointing Chinese manufacturing figures was one of the factors behind a global sell-off in shares. A survey indicated that factory activity had contracted for the first time in seven months in May.

Speaking to reporters in Beijing, IMF first deputy managing director David Lipton said: “The Chinese economy is expected to grow at around 7.75% this year and at about the same pace next year.

“Chinese export growth has been, after years and years of very rapid growth, very slow because of the state of the global economy and we now are taking our projections of the global economy into effect.”

IMF has cuts its economic growth forecast for China, with weakness in the global economy set to hit exports

Among the measures called for by the IMF are slower growth in social financing and a relaxation of controls on interest rates and the exchange rate.

Despite the cut in the IMF’s forecast, David Lipton noted: “Let’s not lose sight of the fact that China is still growing at a very fast rate.

“We’re projecting that growth will remain robust.”

David Lipton added that growth “should pick up moderately in the course of the second half of this year, as the recent credit expansion gains traction and in line with a mild pick-up in the global economy”.

[youtube meNac-FUboM]

French judges have decided to press ahead with the prosecution of Dominique Strauss-Kahn for pimping.

Lawyers for the former International Monetary Fund chief said they would appeal against the decision.

DSK has admitted attending sex parties in northern France, but says he did not know that some of the women present were paid prostitutes.

Last week he reached a settlement with a hotel maid who said he had raped her.

DSK had been accused of trying to rape Nafissatou Diallo in a hotel in New York in May 2011.

The civil case was settled for an undisclosed sum. A criminal investigation was dropped by US prosecutors last year.

On Wednesday, a court in the northern French town of Douai rejected a request by Dominique Strauss-Kahn’s lawyers to drop the inquiry into pimping.

The decision removes the prospect of a quick conclusion to the last inquiry DSK faces.

French judges have decided to press ahead with the prosecution of Dominique Strauss-Kahn for pimping

The case is the last major inquiry DSK faces, and the ruling Wednesday’s ruling removes any prospect of a quick conclusion.

Dominique Strauss-Kahn’s defence lawyers accuse the investigating judges in the case of being biased.

“Dominque Strauss-Kahn’s defence team is certain that he will ultimately be cleared of these absurd accusations of pimping,” lawyer Henri Leclerc said in a statement.

The lawyer added that he planned to take the matter to the supreme court.

The inquiry is known as the Carlton affair – after the name of the hotel in Lille in which the alleged orgies took place.

Consorting with prostitutes is not against the law in France, and DSK has acknowledged that he was at some of the parties with the women.

But DSK’s legal team says he had no idea they were prostitutes, and that there is no evidence to support a formal charge of pimping.

“I challenge you to distinguish a naked prostitute from any other naked woman,” his lawyer has said in his defence.

His lawyers have also argued that the investigation should be annulled due to insufficient grounds.

Dominique Strauss-Kahn, who is reportedly taking steps to reinvent himself as a highly paid consultant and conference speaker, has said the authorities are trying to “criminalize lust”.

Other cases against him have already been dropped.

In October, French prosecutors ended an investigation into allegations of “gang rape” at a hotel in Washington after the woman who made the claim retracted her evidence.

Magistrates also dropped a sexual assault case brought by French author Tristane Banon on the grounds that the alleged 2003 incident had taken place too long ago.

Standard and Poor’s has raised the credit rating of Greece’s sovereign debt by six levels, praising the “strong determination” of fellow European countries to help it stay in the eurozone.

S&P has increased Greece’s rating from “selective default” to “B-minus”.

The rating agency also praised the continuing efforts by Greece’s government to cut its spending.

Greece is currently receiving the second of two bailouts.

Last week, Greece started to receive the latest tranche of the bailout funds from the European Union and International Monetary Fund.

They agreed to release 49.1 billion euros ($57 billion) after continuing austerity work by Greece, and a buyback of some of its debt.

A total of 240 billion euros has been earmarked for Greece from the two bailout loans.

So far, Greece has received nearly 149 billion euros ($191 billion) from the eurozone and the International Monetary Fund, out of that 240billion euros.

S&P said in its statement: “The upgrade reflects our view of the strong determination of European Economic and Monetary Union (eurozone) member states to preserve Greek membership in the eurozone.

“The outlook on the long-term rating is stable, balancing our view of the government’s commitment to a fiscal and structural adjustment against the economic and political challenges of doing so.”

Greece had to seek the bailouts to meet its debt repayments after years of overspending meant it could not keep up with its debt obligations.

The negative market opinion of Greece’s situation only worsened its position, as it pushed up the yield, or level of interest, that the country had to offer on the sale of its new government bonds, in order to attract buyers.

Dominique Strauss-Kahn, the former International Monetary Fund chief, has settled a lawsuit by hotel maid Nafissatou Diallo who accused him of sexual assault, US media report.

Details of the deal, said to have been struck at the Bronx Supreme Court in recent days, are expected to be subject to a confidentiality agreement.

DSK was held in New York in May 2011 after Nafissatou Diallo said he assaulted her in his hotel suite.

Prosecutors later dropped charges amid concerns about her credibility.

Nafissatou Diallo, 33, then opened a civil suit for undisclosed damages against Dominique Strauss-Kahn.

DSK, 63, called the lawsuit defamatory and countersued.

DSK has settled a lawsuit by hotel maid Nafissatou Diallo who accused him of sexual assault

Her case opened the floodgates to a slew of others sexual allegations against DSK, leading him to resign from his IMF post.

It was widely seen as having ruined his chance of becoming the socialist presidential candidate in his native France.

A court date between DSK and Nafissatou Diallo’s lawyers is expected next week, although a day has not been set, reports the New York Times.

She told police that when she arrived to clean his luxury Manhattan hotel room, DSK sexually assaulted her.

DSK admitted to a “moral failing”, but said it was consensual.

Earlier this year DSK separated from his wife of some 21 years, Anne Sinclair.

Sex cases against Dominique Strauss-Kahn

- Civil case on sexual assault charge in New York – settlement apparently reached

- Criminal case on sexual assault charge in New York – dropped August 2011

- Police investigation linking him to suspected vice ring at luxury hotel in Lille, France – ongoing

- Criminal case on attempted rape claims in Paris – dropped October 2011

- Investigation on “gang rape” claims in Washington – dropped October 2012

Latest official figures show that unemployment in Greece hit a record 25.1% in July, with the level among young people reaching 54.2%.

Greece’s statistical authority said 1.26 million Greeks were jobless in July, with more than 1,000 jobs lost every day over the past year.

With austerity cuts continuing and Greece likely to enter another year of recession, the level may rise further.

The worst-affected 15-24 age group, however, includes those in education.

According to Greece’s statistics agency the total unemployment rate rose from 24.8% in June. In July 2008, a year before Greece’s financial crisis broke, there were about 364,000 registered unemployed.

“This is a very dramatic result of the recession,” said Angelos Tsakanikas, head of research at Greece’s IOBE economic research foundation. He did not expect employment to pick up for at least a year.

The Greek economy is surviving on international bailouts, but Athens has been forced to impose tough austerity measures in return for the money.

Finance Minister Yiannis Stournaras will hold talks on Thursday evening with representatives of the European Union, International Monetary Fund and European Central Bank about signing off the release of more funds.

There was some evidence on Thursday that the government’s strategy is working on one front, at least. Finance Ministry figures showed that the deficit-cutting effort is on track despite lower-than-anticipated revenues.

The ministry figures showed that the January-September deficit was 12.64 billion euros, lower than the 13.5 billion-euro target.

Zhou Xiaochuan, the governor of China’s central bank, has pulled out of the International Monetary Fund and World Bank meetings being held in Japan.

The move comes amid an ongoing territorial dispute between the two countries.

Relations between the two soured after Japan said it had purchased disputed islands in the East China Sea claimed by both Tokyo and Beijing.

China’s four state-owned banks have also skipped the meetings.

Zhou Xiaochuan, the governor of the People’s Bank of China, was scheduled to attend the meetings and deliver a speech at the event.

“We were informed two days ago that Governor Zhou’s schedule might require him to cancel his lecture in Tokyo,” an IMF spokesperson said.

“It has now been confirmed that his deputy Yi Gang will represent him at the IMF-World Bank annual meetings and will deliver his Per Jacobsson Lecture.”

Chinese Finance Minister Xie Xuren is also apparently skipping the meetings. Chinese state media said Vice-Minister Zhu Guangyao would attend.

A report on China’s official news agency Xinhua confirmed the make-up of the Chinese central bank delegation.

It also cited unidentified analysts as saying that the four state-owned banks had decided to skip the meetings “because bilateral relations between China and Japan have become strained”.

Japan described the Chinese move as “regrettable”.

The territorial dispute has affected both political and trade ties between the two neighbors.

On Tuesday, Japanese carmakers reported a dramatic drop in sales in China, after recent protests in the country targeting Japanese products and businesses.

Toyota reported a 49% drop in sales in September, while Honda and Nissan’s sales fell 40% and 35% respectively.

Other carmakers such as Mitsubishi Motors and Mazda have also reported a sharp drop in Chinese sales.

The protests had led to various Japanese firms temporarily suspending their operations in China.

Dion Corbett, spokesperson for Toyota, Japan’s biggest carmaker, said the slump in sales meant that its sales targets for China might be “very difficult to achieve”.

The territorial row has rumbled for decades. Both China and Japan claim the islands, called Senkaku in Japan and Diaoyu in China.

Taiwan also claims the islands, which lie in important shipping lanes and fishing grounds, and also close to waters thought to contain natural resources.

This row flared over Japan’s purchase of some of the islands from their private owner – a move prompted by a potentially more provocative plan by right-wing Tokyo Governor Shintaro Ishihara to buy them using public donations and develop them.

Since then both Chinese and Taiwanese vessels have been sailing in and out of what Japan says are its territorial waters around the islands. The US, meanwhile, has called for calm, with US Secretary of State Hillary Clinton urging “cooler heads to prevail”.

According an independent audit, Spain’s banks will need an injection of 59.3 billion euros ($76.3 billion) to survive a serious downturn.

The amount is broadly in line with market expectations of 60 billion euros, and follows so-called stress tests of 14 Spanish lenders.

Much of the money is expected to come from the eurozone rescue funds, the current EFSF and the future ESM.

Spain said in July that it would request eurozone support for its banks.

The Spanish banking sector has been in difficulty since the global financial crisis of 2008, and the subsequent bursting of the country’s property bubble and deep recession.

Spain’s banks will need an injection of 59.3 billion euros to survive a serious downturn

The European Commission welcomed the announcement, saying in a statement that it “is a major step in implementing the financial-assistance programme and towards strengthening the viability of, and confidence in, the Spanish banking sector”.

It added: “The necessary state aid provided to Spanish banks will be determined in the coming months.”

The Commission also said that it expected the first Spanish banks to start receiving the loans “by November.”

Christine Lagarde, managing director of the International Monetary Fund, praised the independent valuation of Spain’s banks, saying it had been “thorough and transparent”.

She added: “Public funding of the banks’ actual capital needs, which are expected to be lower than the amounts identified in the stress tests, can be financed comfortably under the recapitalization programme supported by Spain’s European partners.”

The audit calculation that Spain’s banks will need 59.3 billion euros is a worst-case scenario, and does not take into account any future plans by the lenders themselves to raise their own capital.

The country’s economy minister Fernando Jimenez Latorre indicated that it may need to borrow about 40 billion from the eurozone rescue funds.

Bankia was found to be the bank most in need of additional capital, requiring 24.7 billion euros. It was followed by Catalunya Bank (10.8 billion euros), Novagalicia (7.2 billion euros), Banco de Valencia (3.5 billion euros), Banco Popular (3.2 billion euros), Banco Mare Nostrum (2.2 billion euros), and Ibercaja-Liberbank-Caja (2.1 billion euros).

Seven Spanish banks have no need for extra capital – Santander, BBVA, Caixabank, Kutxabank, Sabadell, Bankinter, and Unicaja.

The audit was also based on a number of assumptions, including that Spain’s economy will contract by 6.5% between 2012 and 2014.

The Open Europe think tank suggested many of these were overly optimistic, however.

“These tests do look to be more intense than the previous ones but ultimately the optimistic assumptions do instantly raise questions over their credibility,” the group said.

“The prediction that unemployment will peak at 27.2% seems optimistic given that there is plenty more austerity and internal devaluation to come while the structural labor market reforms are yet to take effect.”

It added that a worsening economic situation would also increase the number of loans which are defaulted on and hit the value of the foreclosed properties which banks own.

The bigger question remains whether the Spanish government will have to follow Greece, Portugal and the Republic of Ireland and request a full international bailout, involving loans that have to be paid off by the state, as well as close monitoring of its economy by its international creditors.

While Madrid continues to publicly deny this, the markets consider it only a matter of time.

On Thursday, the Spanish government announced its latest austerity budget. Against a backdrop of violent protests, it outlined new spending cuts, but protected pensions.

Spain is struggling with a shrinking economy and 25% unemployment.

Comments from its central bank earlier this week indicated that the country’s recession deepened in the past three months.

As tax revenues fall and benefits payments rise in a recession, this will make it even harder for Spain to get its finances under control.

European Central Bank’s president, Mario Draghi, has unveiled details of a new bond-buying plan aimed at easing the eurozone’s debt crisis.

Mario Draghi said the scheme would provide a “fully effective backstop” and that the euro was “irreversible”.

The ECB aims to cut the borrowing costs of debt-burdened eurozone members by buying their bonds.

Ahead of the announcement, the central bank kept the benchmark eurozone interest rate unchanged at 0.75%.

Mario Draghi said the ECB would engage in outright monetary transactions (OMTs) to address “severe distortions” in government bond markets based on “unfounded fears”.

He insisted that the ECB was “strictly within our mandate” of maintaining financial stability, but reiterated the need for governments to continue with their deficit reduction plans and labor market reforms.

He added that the ECB’s actions came in response to eurozone economic contraction in 2012, with continued weakness likely to continue into 2013.

The ECB expects the eurozone economy to shrink by 0.4% in 2012 and grow by 0.5% in 2013, with inflation rising to 2.6%.

European Central Bank’s president, Mario Draghi, has unveiled details of a new bond-buying plan aimed at easing the eurozone's debt crisis

OMTs will only be carried out in conjunction with European Financial Stability Facility or European Stability Mechanism programmes, he said.

In other words, countries will still have to request a bailout before the OMTs are triggered.

The maturities of the bonds being purchased would be between one and three years and there would be no limits on the size of bond purchases, he added.

The ECB will ask the International Monetary Fund to help it monitor country compliance with its conditions.

Responding to the plans, Peter Westaway, chief economist for Europe at asset manager Vanguard, said: “This is just the good news that was priced by the markets, and it has now been confirmed.

“There is a long-term question of whether this will be enough to meet the long-term financing needs of Italy, and that probably remains.”

European stock markets reacted positively to the announcement, with the FTSE 100 surging 2.1%; the German Dax, 2.91%; the French Cac 40 index, 3.06%; and the Spanish IBEX, 4.91% at the close.

Bank shares in particular rose sharply on the news, with French banks Credit Agricole and Societe Generale up 8.44% and 7.76% respectively, while in Germany, Deutsche Bank rose 7.06% and Commerzbank, 5.25%. In London, Lloyds Banking Group rose 6.69%.

However, the euro fell back against the dollar to $1.2571 following its high of $1.265 reached before the ECB announcement.

While Mario Draghi was announcing the ECB’s plans, German Chancellor Angela Merkel was meeting Spanish Prime Minister Mariano Rajoy for talks on the eurozone crisis.

In a joint news conference afterwards, Angela Merkel said: “We have to restore confidence in the euro as a whole, so that the international markets have confidence that member countries will fulfil their commitments.”

Mariano Rajoy said: “We want to dispel any doubts on the markets about the continuity of the euro.”

Jens Weidmann, president of Germany’s Bundesbank, remains vigorously opposed to the ECB’s plan, concerned that member states could become hooked on central bank aid and failed to reform their economies sufficiently.

But the majority of the 23 ECB council members support the plan.

And the Organization for Economic Co-operation and Development (OECD) added its support for the ECB bond-buying plan on Thursday, as it warned that the eurozone crisis posed the greatest risk to the global economy.

It is calling for more action from central banks to prevent a break-up of the eurozone.

“Concerns about the possibility of exit from the euro area are pushing up [government bond] yields, which in turn reinforces break-up fears,” the OECD said in its global economic outlook.

“It is crucial to stem these exit fears. This could be achieved by the ECB undertaking bond market intervention to keep spreads within ranges justified by fundamentals.”

Mario Draghi is hoping that ECB intervention in the bond markets will help reduce the borrowing costs of debt-laden countries such as Spain and Italy and lessen the likelihood of them needing to ask for a full sovereign bailout, an eventuality that could bankrupt the eurozone and cause the collapse of the euro.

Spain, which has already asked for 100 billion euros in state aid to help its debt-stricken banks, is currently paying yields of 6.42% on its 10-year bonds, while Italy’s 10-year bond yields are 5.51%, below the critical 7% figure thought likely to trigger a sovereign bailout request.

Outright Monetary Transactions (OMTs)

The term used for the European Central Bank’s programme of buying government bonds with maturities of between one and three years with the aim of reducing a specific country’s borrowing costs. OMTs are only triggered if a country has applied to the European Financial Stability Facility or European Stability Mechanism for financial assistance and are conditional on a government putting in place financial reforms approved by eurozone financial authorities and monitored by the International Monetary Fund.

French President Francois Hollande has urged Greece to prove it can pass reforms demanded by international creditors, after talks with PM Antonis Samaras.

Greek PM Antonis Samaras has been appealing for more time to introduce the reforms.

But Francois Hollande said no further decision could be taken until European ministers consider a major report on Greece’s finances, due in September.

Donors including the EU insist Greece has to make major spending cuts.

These are needed if Greece is to secure the next tranche of its bailout.

French President Francois Hollande has urged Greece to prove it can pass reforms demanded by international creditors, after talks with PM Antonis Samaras

The Greek government is under pressure to win concessions from Europe to placate the tired nation and lessen the likelihood of a destabilizing period of social unrest.

Antonis Samaras is seeking an extension of up to two years for the necessary reforms, in order to provide Greece with the growth needed to improve its public finances.

In talks with German Chancellor Angela Merkel earlier this week, he was told that the decision would depend on a report from the so-called troika – the International Monetary Fund (IMF), the European Central Bank (ECB) and the European Commission.

Francois Hollande also said Europe needed to consider the report before it could make any further decisions on Greece.

He said decisions on whether to grant Greece more time should be taken when European finance ministers meet in early October.

“We’ve been facing this question for two and a half years, there’s no time to lose, there are commitments to reaffirm on both sides, decisions to take, and the sooner the better,” he said.

Greece’s continued access to the bailout packages depends on a favorable report from the troika.

Athens is trying to finalize a package of 11.5 billion euros ($14.4 billion) of spending cuts over the next two years.

It is also being asked to put in place economic and structural reforms, including changes to the labor market and a renewed privatization drive.

The measures are needed to qualify for the next 33.5 billion-euro installment of its second 130bn-euro bailout.

Greece needs the funds to make repayments on its debt burden. A default could result in the country leaving the euro.

German Chancellor Angela Merkel and French President Francois Hollande are set to hold talks in Berlin on whether to give Greece more time to make the cuts required by its debt bailout.

Angela Merkel and Francois Hollande will also meet Greek Prime Minister Antonis Samaras later this week.

Meeting Antonis Samaras yesterday, eurozone chief Jean-Claude Juncker kept the door open for a change to the bailout terms.

Heavily-indebted Greece is in its fifth year of recession and austerity.

Greece is currently trying to finalize a package of 11.5 billion euros ($14.4 billion) of spending cuts over the next two years.

It is also being asked to put in place economic and structural reforms, including changes to the labor market and a renewed privatization drive.

The measures are needed to qualify for the next 33.5 billion-euro installment of its second 130bn-euro bailout.

Angela Merkel and Francois Hollande are set to hold talks in Berlin on whether to give Greece more time to make the cuts required by its debt bailout

The “troika” of donor bodies monitoring the bailout – the International Monetary Fund (IMF), the European Central Bank (ECB) and the European Commission – are due in Athens next month to report on whether Greece has made enough progress.

Greece needs the funds to make repayments on its debt burden. A default could result in the country leaving the euro.

Antonis Samaras is seeking an extension of up to two years for the painful steps, in order to provide Greece with the growth needed to improve its public finances.

In an interview published on Wednesday, he told Germany’s biggest daily, Bild, that his country needed “a little breathing space” in order to kick-start growth and reduce its deficit.

After meeting Antonis Samaras on Wednesday, Eurogroup head Jean-Claude Juncker said a decision on an extension would depend on the troika’s report.

“We have to discuss the length of the period and other dimensions,” Jean-Claude Juncker told a news conference, while sitting alongside Antonis Samaras.

He said Greece was facing its “last chance” to make the necessary changes, but praised the “tremendous efforts” it has made so far to cut its deficit. He also stressed he was “totally opposed” to Greece leaving the euro.

Antonis Samaras called the discussions “fruitful”.

At least publicly, many EU leaders remain resolutely opposed to any moves to change the terms of Greece’s bailout.

But Jean-Claude Juncker’s remarks suggest there is room for manoeuvre and that an extension has not been ruled out.

Angel Merkel has said that she and Antonis Samaras will not make any decisions on the issue in their talks on Friday. Antonis Samaras goes on to meet Francois Hollande on Saturday.

On Wednesday, Francois Hollande also discussed Greece with British Prime Minister David Cameron in a telephone call.

“Both welcomed the recent actions of the ECB and agreed that this did not negate the need for Greece to stabilize their own economy and prevent any further detrimental effects to the wider eurozone,” David Cameron’s office said in a statement, without specifying which ECB actions they were referring to.

The talks come amid reports that due to the worsening state of the economy, which affects tax receipts and welfare spending levels, Greece may now need to find savings of up to 13.5 billion euros – 2 billion more than thought.

Greece discussions timetable

• 22 August: Greek PM Antonis Samaras meets Eurogroup chief Jean-Claude Juncker

• 23 August: Angela Merkel and Francois Hollande meet

• 24 August: Chancellor Merkel and PM Samaras meet

• 25 August: President Hollande and PM Samaras meet

• Early September: Troika staff go back to Greece

• 14-15 September: Gathering of European finance ministers in Cyprus

• Troika’s review of progress to be published by the end of September

• 8-9 October: Finance ministers attend two days of meetings in Luxembourg

Representatives from the troika of international lenders arrive in Greece on Tuesday to assess its progress towards reducing its huge debts.

They must decide whether Greece is eligible to receive 31.5 billion Euros – the last tranche of a 130 billion Euro ($158 billion) aid package agreed in March.

Athens is behind in its plans to cut spending and debt because its economy is shrinking faster than forecast.

The Greek prime minister is expected to ask for more time to repay its loans.

The International Monetary Fund (IMF), European Central Bank (ECB) and European Commission (EC) make up the troika.

The IMF said it was “supporting Greece in overcoming its economic difficulties” and would work with the country to get it “back on track”.

However, reports over the weekend suggested that the IMF would refuse calls for further aid.

Representatives from the troika of international lenders arrive in Greece on Tuesday to assess its progress towards reducing its huge debts

Greece has promised to reduce its budget deficit to below 3% of annual national income as measured in Gross Domestic Product (GDP) by the end of 2014. At the end of last year, Greece’s overspend was equivalent to 9% of GDP in 2011.

Successive Greek governments have managed to trim 17bn euros from government spending. That has brought the country’s total debt down from more than 160% of GDP to 132% according to official figures released on Monday.

Under the terms of its international loan agreement with the troika, Greece has vowed to reduce its total debt to 120% of GDP by 2020.

However, Prime Minister Antonis Samaras would have had to have raised another 12 billion Euros through higher taxes and the sale of public assets such as the country’s loss-making railways to have met this bailout target.

Still worse, Greece’s economy is shrinking faster than most had forecast. The Bank of Greece expects GDP to shrink 5% this year in its deepest recession since the 1930s.

As a result, economists calculate that Greece may need a third rescue package worth up to 50 billion Euros.

The re-run of general elections and political instability as parties scrambled to form a governing coalition has delayed work by the troika and the government to agree a credible plan to restore the nation’s finances.

A European Commission spokesman said the troika would not be in a position to report its findings and release the final 31.5 billion euro installment of bailout money until September.

“The Commission is confident that the decision on the next disbursement will be taken in the near future, although it is unlikely to happen before September,” he said.

That leaves Greece in a difficult situation. A 3.8 billion euro debt repayment to the ECB falls due on 20 August. Without the troika money, the ECB may be forced to step in to provide temporary aid.

But further debt repayments are due in September so failure to secure the bailout money could push Greece to the brink of insolvency.

If Greece were to default on its outstanding loans that, in turn, could force it to exit the eurozone and return to the drachma.

*Troika

The term used to refer to the European Union, the European Central Bank and the International Monetary Fund – the three organizations charged with monitoring Greece’s progress in carrying out austerity measures as a condition of bailout loans provided to it by the IMF and by other European governments. The bailout loans are being released in a number of tranches of cash, each of which must be approved by the troika’s inspectors.

Eurozone finance ministers are to hold a conference call to discuss a bailout for Spanish banks.

EU sources say Madrid could formally request financial assistance for its troubled banks this weekend.

So far Spain has denied reports that an announcement on a European rescue plan for its banks is close.

The International Monetary Fund (IMF) is estimating that Spain’s banks need a cash injection of at least 40 billion Euros ($50 billion).

The IMF said on Friday that a “stress test” showed Spain’s financial sector was well managed but “vulnerable”.

The eurozone finance ministers’ conference call is expected early on Saturday afternoon.

In an interview on Portuguese radio, European Central Bank Vice-President Vitor Constancio said: “It is expected that Spain will formulate a request for aid exclusively for banks recapitalization.

“There has to be an expression of will to have such a programme for Spanish banks, and one may hope it happens rather swiftly.”

Eurozone finance ministers are to hold a conference call to discuss a bailout for Spanish banks

Spain is under pressure from Brussels to act, possibly before the feared uncertainty that could follow next weekend’s Greek elections.

However on Saturday morning, the Spanish government restated its position that it does not need outside help to shore up its banks.

“There has been no change,” a spokeswoman from the economy ministry in Madrid told AFP news agency.

Spanish Prime Minister Prime Minister Mariano Rajoy has insisted that any decision will come after the results of an independent audit on the Spanish banking system, which are due out within two weeks.

The audit will produce a figure of how much money, in total, is needed to prop-up Spain’s banks.

A rescue deal would see money passed first to the Spanish government and then to the troubled banks.

Because Madrid has already announced tough financial reforms it is likely that a deal would only carry limited conditions, our correspondent says, unlike the full-blown bailouts for Greece, Portugal and Ireland.

Reuters reported that eurozone deputy finance ministers would first hold a conference call on Saturday morning to discuss a Spanish request for aid.

The Eurogroup of finance ministers would then discuss the issue on another conference call, the news agency said, citing unnamed EU and German officials.

A downgrade of Spain’s creditworthiness by rating agency Fitch earlier this week has been seen by some as adding to the urgency of shoring up Spain’s finances.

European leaders have to make difficult decisions to steer the eurozone away from crisis, US President Obama said on Friday.

He said the US would support Europe as it implemented the hard solutions needed to solve the ongoing debt crisis.

He said a deep new recession in Europe would have an impact on the US economy.

Greece’s future in the eurozone was a matter for the Greek people, he said, but “further hardship” must be expected if the country chose to leave the euro.

Greeks will go to the polls on 17 June to try and end a political impasse that eurozone leaders say is harming Greece’s ability to tackle its economic crisis.

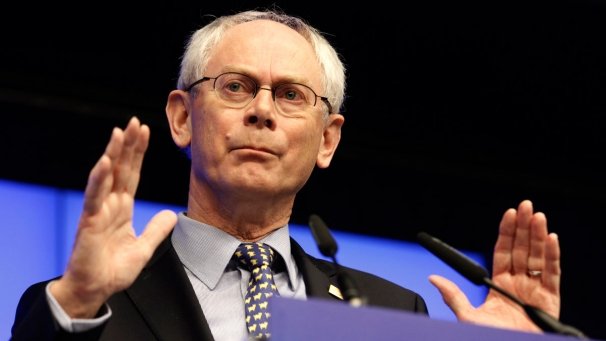

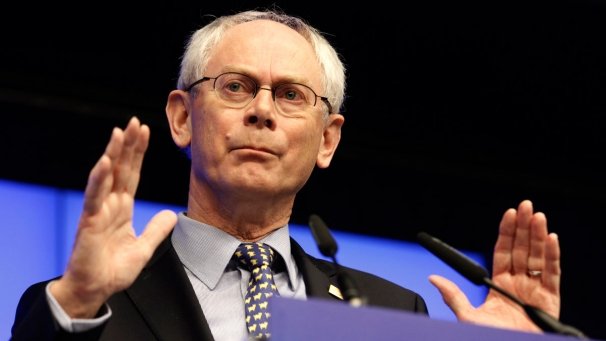

European Council President Herman Van Rompuy has announced that EU leaders want Greece to remain in the eurozone but to “respect its commitments”.

Herman Van Rompuy, speaking at an informal EU summit, said continuing “vital reforms” were essential for Greece to overcome its economic problems.

The eurozone crisis has overshadowed the talks, amid fears that Greece may have to exit the single currency.

The eurozone is said to be preparing for such a scenario.

“We want Greece to remain in the euro area while respecting its commitments,” Herman Van Rompuy told a news conference in Brussels.

“We are fully aware of the significant efforts already made by the Greek citizens.

“The eurozone has shown considerable solidarity having already disbursed, together with the IMF (International Monetary Fund) nearly 150 billion Euros in support of Greece since 2010.”

European Council President Herman Van Rompuy has announced that EU leaders want Greece to remain in the eurozone but to "respect its commitments"

He said the EU would take action to return Greece to economic growth and job creation.

But Herman Van Rompuy said “continuing vital reforms” were “the best guarantee for a more prosperous future in the euro area”.

Referring to Greece’s forthcoming elections in June he said: “We expect that after the elections the new Greek government will make that choice.”

On Wednesday, European stock markets fell about 2% amid anxiety that Greece might have to exit the euro.

herman Van Rompuy said talks had been “focused and frank”.

He said there was agreement on the need for economic growth as well as measures to restore financial stability, which he described as “two sides of the same coin”.

UK Prime Minister David Cameron emphasized the agreements that EU leaders had reached on Wednesday.

“It was a good meeting in that there was complete agreement that dealing with deficits and getting growth are not alternatives, they go together. You need to do one in order to get the other,” David Cameron said.

Greece’s caretaker Prime Minister Panagiotis Pikrammenos said he had “had the support from almost every country member”.

EU leaders began the summit with Germany resisting pressure to launch eurobonds as a way to ease the eurozone crisis.

German Chancellor Angela Merkel said the bonds, pooling eurozone debt, would violate EU treaties and would “not contribute to kick-starting growth”.

France’s President Francois Hollande said that he wanted discussion of eurobonds and Irish PM Enda Kenny said the idea would be on the table.

Earlier, Angela Merkel said talks would not result in decisions but would influence formal summit talks in late June.

The leaders would look at ways to deepen the EU internal market, boost mobility in Europe’s labor market and better target European Investment Bank funding for projects. Such measures could help stimulate growth, she said.

The summit has been the first opportunity for President Francois Hollande to shift the emphasis from austerity to growth – a key message he gave to French voters, who elected him on 6 May.

The French Socialist leader’s victory is seen as a challenge to the prevailing austerity drive in the EU, which is favored by Germany.

There is more and more speculation that Greece is about to leave the euro.

Greece has been unable to form a government, and new elections seem set to give power to parties that reject the spending cuts that have been agreed with other eurozone governments and the International Monetary Fund.

But without those spending cuts, the Greek government will receive no more bailout loans, it won’t have the money to pay its debts, the Greek banks will probably go bust, and the European Central Bank may be forced to cut Greece loose from the single currency.

What would this mean for Greece and the rest of Europe?

1. Greek meltdown

Greece’s banks would be facing collapse. People’s savings would be frozen. Many businesses would go bankrupt. The cost of imports – which in Greece includes a lot of its food and medicine – could double, triple or even quadruple as the new drachma currency plummets in value. With their banks bust, Greeks would find it impossible to borrow, making it impossible for a while to finance the import of some goods at all. One of Greece’s biggest industries, tourism, could be disrupted by political and social turmoil.

In the longer run, Greece’s economy should benefit from having a much more competitive exchange rate. But its underlying problems, including the government’s chronic overspending, may not go away.

2. Bank runs

Ordinary Greeks may queue up to empty their bank accounts before they get frozen and converted into drachmas that lose half or more of their value. Depositors in other eurozone countries seen as being at risk of leaving the euro – Spain, Italy – may also move their money to the safety of a German bank account, sparking a banking crisis in southern Europe.

Confidence in other banks that have lent heavily to southern Europe- such as the French banks – may also collapse. The banking crisis could spread worldwide, just like in 2008. The European Central Bank may have to provide trillions of Euros in rescue loans to the banks. Some governments may not have enough money to prop up their banks with the extra capital needed to absorb losses and restore confidence; the banks could then go bankrupt.

Greece has been unable to form a government, and new elections seem set to give power to parties that reject the spending cuts that have been agreed with other eurozone governments and the International Monetary Fund

3. Business bankruptcies

Greek businesses face a legal and financial disaster. Some contracts governed by Greek law are converted into drachmas, while other foreign law contracts remain in Euros. Many contracts could end up in litigation over whether they should be converted or not.

Greek companies who still owe big debts in Euros to foreign lenders, but whose main sources of income are converted to devalued drachmas, will be unable to repay their debts. Many businesses will be left insolvent – their debts worth more than the value of everything they own – and will be facing bankruptcy. Foreign lenders and business partners of Greek companies will be looking at big losses.

4. Sovereign debt crisis

Sovereign debt is the money a government borrows from its own citizens or from investors around the world. But if Greece leaves the eurozone, setting a precedent that such a thing can happen, then investors will become very nervous about lending to other struggling eurozone countries.

This could leave the governments of Spain and Italy short of money and in need of a bailout. These two huge countries together account for 28% of the eurozone’s total economy, but the EU’s bailout fund currently doesn’t have enough money to prop both of them up. Even France’s government could get into trouble if it needed to bail out its enormous banking sector.

5. Market turmoil

Nervous investors and lenders around the world may start selling off risky investments and move their money into safe havens. Stock markets may plunge. High-risk borrowers could face sharply higher borrowing costs, if they can borrow at all.

Meanwhile, safe investments such as the dollar, the yen, the Swiss franc, gold and perhaps even the pound would rise, while safe governments such as those of the US, Japan, Germany and even the UK could borrow more cheaply. And it’s not all bad news – the oil price may well fall sharply.

6. Political backlash

As eurozone governments and the European Central Bank face enormous losses on the loans they gave to Greece, public opinion in Germany may turn against providing the even larger bailouts probably now needed by big countries like Italy and Spain. The ECB’s role of quietly providing rescue loans to these countries in recent months would be exposed and could become politically explosive, making it harder for the ECB to continue to prop up their economies.

However, the threat of a meltdown might push Europe’s or the eurozone’s governments to agree a comprehensive solution – either dissolution of the single currency, or more integration, perhaps through a democratically-elected European presidency tasked with overseeing a massive round of bank rescues, government guarantees and growth-stimulating infrastructure investment.

7. Recession

Crisis-stricken eurozone banks may be forced to slash their lending. Businesses, afraid for the euro’s future, may cut investment. Faced with a barrage of bad news in the press, ordinary people may cut back their own spending. All of this could push the eurozone into a deep recession.

The euro would lose value in the currency markets, providing some relief for the eurozone by making its exports more competitive in international trade. But the flipside is that the rest of the world will become less competitive – especially the US, UK and Japan – undermining their own weak economies. Even China, whose economy is already slowing sharply, could be pushed into a recession.

8. Greek debt default

Unable to borrow from anyone (not even other European governments), the Greek government simply runs out of Euros. It has to pay social benefits and civil servants’ wages in IOUs (if it pays them at all) until the new drachma currency can be introduced. The government stops all repayments on its debts, which include 240 billion Euros of bailout loans it has already received from the IMF and EU. The Greek banks – who are big lenders to the government – would go bust.

Meanwhile, the Greek central bank may be unable to repay the 100 billion Euros or more it has borrowed from the European Central Bank to help prop up the Greek banks. Indeed, by the time Greece leaves the euro, the central bank may have borrowed even more from the ECB in a last ditch effort to stop the Greek banks collapsing.

A New York civil court has begun hearing the case against former IFM chief Dominique Strauss-Kahn, brought by Nafissatou Diallo, the Sofitel hotel maid who accused him of a sex attack last year.

Nafissatou Diallo brought the action after criminal charges were dismissed against the former head of the International Monetary Fund (IMF).

The charges were dropped when prosecutors lost faith in her evidence.

Dominique Strauss-Kahn is not in court. He is fighting claims in France that he was involved with a prostitution ring.

The hearing in New York is the first stage in the civil case brought by Nafissatou Diallo.

Nafissatou Diallo maintains DSK attacked her when she came to clean his suite at the Sofitel Hotel in New York.

Nafissatou Diallo brought the civil action after criminal charges were dismissed against DSK

Judges must decide whether the case can proceed.

DSK’s lawyers argued in court that the case should be dropped, saying the defendant had diplomatic immunity at the time of the alleged assault.

“Dismissal, your honor, may seem like an unfair result to some, but it’s the result the law compels,” Amit P. Mehta, one of DSK’s lawyers, told the judge.

But the IMF has said Dominique Strauss-Kahn was not entitled to immunity because he was in New York on personal business at the time.

In France, DSK has been placed under investigation over allegations that he was involved in a hotel prostitution ring in the northern city of Lille.

DSK has admitted he attended sex parties, but denies that he knew the women involved in the orgies were hired prostitutes.

Leaked police documents emerged on Wednesday that appear to show that he exchanged text messages with the people running the parties, in which prostitutes were referred to as “material”.

Prosecutors claim the term suggests he knew the identity and profession of the women taking part.

At least one of those women has told police there was undue aggression at these events, an allegation Dominique Strauss-Kahn strenuously denies.

The parties DSK attended were stopped soon after his arrest in May last year.

The European Commission warns Hungary that it faces legal action if it fails to change reforms to its central bank, data protection and judiciary.

Hungary’s PM Viktor Orban was given a month to respond, Reuters news agency reports.

Critics say the new central bank law puts the bank’s independence at risk. It allows Viktor Orban to install a new deputy governor.

Viktor Orban’s conservative Fidesz party has a two-thirds majority in parliament.

The European Commission launched an “infringement procedure” against Hungary on Tuesday, the first stage of which is a warning calling for changes to the controversial laws.

“We do not want a shadow of doubt on respect for democratic principles and values to remain over the country any longer,” Commission President Jose Manuel Barroso said.

There are fears that a new data protection authority will come under Fidesz influence and that a plan to make hundreds of judges retire early will undermine the judiciary’s independence by enabling new pro-Fidesz appointees to replace them.

The European Commission can go as far as imposing fines and taking Hungary to the European Court of Justice.

Thousands of Hungarians have demonstrated over what they see as Fidesz authoritarianism. A new media authority set up by Fidesz is also highly controversial.

The changes are part of a new constitution which took effect on 1 January.

Viktor Orban says the criticisms are politically motivated. He argues that partisan bickering has for too long handicapped Hungarian politics and that the last vestiges of communist influence need to be rooted out.

Correspondents say a compromise may be found because Hungary is struggling to service its debts and wants to reach a new deal with the EU and International Monetary Fund on a standby loan.

Hungary’s total debt has risen to 82% of its output, while its currency, the forint, has fallen to record lows against the euro.

The EU Economic and Monetary Affairs Commissioner, Olli Rehn, has already warned that Hungary could face a suspension of EU cohesion funds – support for regional projects.

Nearly a year ago a row between Hungary and the Commission was defused when Viktor Orban’s government agreed to amend the wording of the new media law, in the sections on balanced reporting, country of origin and media registration.