Home Tags Posts tagged with "bank of america"

bank of america

Twenty eight banks out of 31 have passed the Fed’s annual stress test in the US.

As part of the Comprehensive Capital Analysis and Review (CCAR), the Fed evaluates a bank’s capital adequacy and planned distributions, such as dividend payments and common stock repurchases.

Deutsche Bank and Banco Santander failed for “qualitative” reasons and Bank of America will need to resubmit their proposal.

[youtube Oio2fafsa8I 650]

US units of Deutsche Bank AG and Banco Santander SA have failed a US “stress test” designed to assess whether lenders can withstand another financial crisis.

The review, carried out by the Federal Reserve, gauges whether the biggest banks operating in the US have the “ability to lend to households and businesses even in times of stress”.

Another institution, Bank of America, has been asked to revise its financial plans due to “certain weaknesses”.

A further 28 banks passed the tests.

Officially known as the Comprehensive Capital Analysis and Review (CCAR), the tests were implemented in the aftermath of the 2008 financial crisis, in which some lenders needed bailouts from the Fed.

All banks with more than $50 billion in assets are subject to the annual examinations, which assess the corporations’ ability to deal with “doomsday” scenarios, such as rising unemployment and plummeting house prices.

In previous years, banks that failed the tests have been forced to suspend dividend payments to shareholders.

In a statement, Deutsche Bank said it had hired 1,800 employees “dedicated to ensuring that its systems and controls are best in class”.

Santander’s US chief executive, Scott Powell, said the bank still had “meaningful work to do to meet our regulator’s expectations and our own standards of excellence”.

However, Santander added that it had not been prevented from paying dividends.

[youtube Oio2fafsa8I 650]

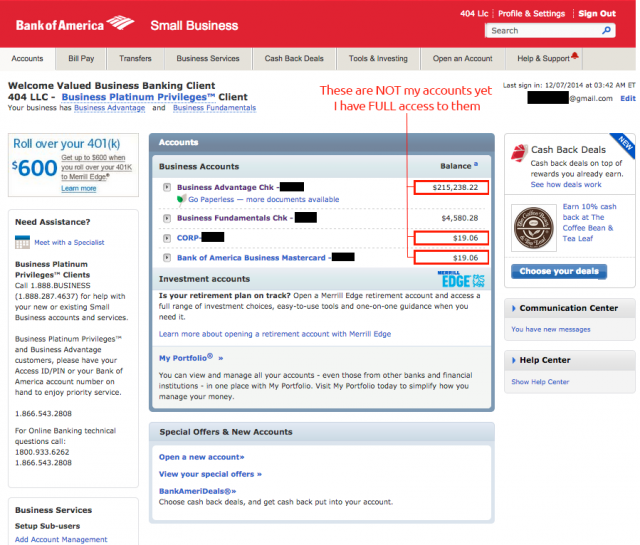

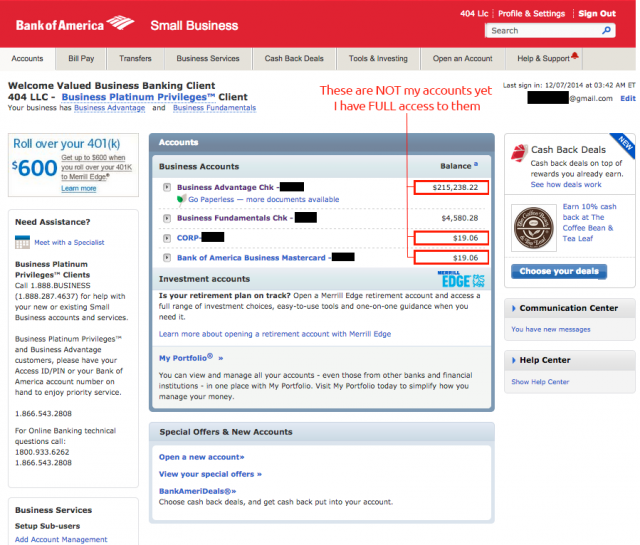

A Bank of America’s client claims that he got full access to someone else’s account because they had the same user name.

After the bank mistakenly granted him with $215,238.22, the California man says he decided to leave banks entirely for Bitcoin.

“This is the exposure of a fundamental problem of a bank not able to operate under the tenets of a bank,” he wrote in a post on reddit.com.

“I’ve moved everything out of the banking system but what is necessary to be able to operate conveniently in the fiat economy. After what just happened I realize I have to go full bitcoin,” he added.

The man then explained how Bank of America made him “almost a quarter million dollars” richer:

- I logged into Bank of America and immediately noticed that I had almost a quarter million dollars more than I did the day before. My account is there, and so are some other accounts.

- I looked through the transactional details of the unfamiliar account and online statements. It definitely wasn’t an old account of mine that someone had generously funded without telling me. This is someone else’s account and I have full access to it and all information associated with it. I do a test and get as close as I can to transferring money out it without clicking the final button. It’s obvious I can transfer money out of it.

- I realize that calling online banking support will put the issue in the hands of an attendant who views this as a technical problem that is solved by merely moving the accounts out of my login without realizing how fundamentally significant this is. Open ticket, close ticket, nothing to see here.

- I drive to the local branch and request the manager. I tell him that if he has a few moments I have something interesting to show him. I provide my debit card and ask him to pull up my account. He does. I ask him how much is available for immediate withdrawal. He says approximately $220,000. I tell him it isn’t my money and the bulk of that money is in an account that isn’t mine. We stare at each other for a long time.

- After he gathered his wits about him he starts making phone calls to escalate the matter. After two hours they still have no explanation and are having difficulty removing the well funded account from my login. Apparently the account belongs to a company with the same user name that I have. Which is impossible in their system. The only way they can get the money out of my reach is to destroy my online profile and recreate it with a new user name. I’m led to believe that my account and information has been made accessible to the other company as well.

- He starts to fill out lots of forms. He says “This form has a check box I need to ask you about. Based on what I know about you, I assume you are going to the media. Have you done so already or will you?” I say “No I haven’t and yes I will. In addition, when I leave your office my next phone call is to the owner of this account. I assume if I don’t tell him what happened with his money and information, no one else will. I’m going to tell him his bank balance and ask him if he has a good lawyer. I also want you to include in your notes that I’m demanding an affidavit from Bank of America stating that during the time I was granted access to these funds I didn’t take any.”

- I was given a case number and informed that I would be contacted by a “special internal group” that has “questions” about the screen shots I took to document the matter. I suppose “questions” is another way of saying “demands that I destroy evidence of the bank’s wrong doings”. So far I’ve heard nothing.

- I leave the branch and call the owner of the business whose account I’d been granted access to. Apparently there’s no diplomatic way to start a conversation like this and I’m hung up on twice. The third time I got the owner and blurted out his account balance before he could hang up. Now he’s listening. I explained everything and, long story short, he didn’t seem to be concerned at all about what happened. He has too much faith in the banking system to believe there could be risk.

The Bank of America customer says he wanted to share the story to let people “to determine the quantity and degree of ways Bank of America breached policy, contract, fiduciary responsibility, protection of privacy and the extent to which the software that manages trillions of dollars may be flawed”.

BelleNews.com has contacted both Bank of America and its customer for comments. We will keep you updated.

More info to come soon…

Bank of America has reported a net profit of $168 million in Q3 2014, down from $2.5 billion a year earlier.

Total revenue was $21.4 billion.

The huge drop in profits was due to a previously announced $5.3 billion mortgage-related settlement with the Department of Justice and other federal agencies.

Most areas of the business improved profitability compared with a year ago.

Bank of America has reported a net profit of $168 million in Q3 2014, down from $2.5 billion a year earlier

“We saw solid customer and client activity and improved profitability in most of our businesses relative to the year-ago quarter,” said Bank of America’s chief executive Brian Moynihan.

The bank’s property business posted a loss of $5.2 billion, compared with a loss of $990 million a year earlier.

Profits at the asset management arm rose slightly to $813 million, while those at the global banking division rose by a quarter to $1.4 billion.

The global markets business turned a loss of $875 million to a profit of $769 million.

On October 14, rival JP Morgan reported a profit of $5.6 billion for Q3 2014, while Citigroup posted a $3.4 billion profit.

[youtube J27y8k7rId4 650]

Bank of America has agreed pay a record settlement of $16.7 billion for misleading investors about the quality of loans it sold.

The loans were sold by Countrywide Financial and Merrill Lynch before Bank of America bought them in 2008, at the height of the financial crisis.

The associate attorney general said “no institution is either too big or too powerful to escape” punishment.

The settlement will cut the bank’s third-quarter profits by $5.3bn.

Bank of America will pay a total of $9.65 billion in cash and provide consumer relief worth about $7 billion, much of which will go towards homeowners struggling with their mortgages.

The cash component consists of a $5 billion civil penalty and $4.63 billion in compensation payments.

The case centered on Countrywide Financial, the biggest lender at the time of the crisis, and Merrill Lynch selling mortgage loans to investors but not explaining the full extent of the risk involved.

Bank of America has agreed pay a record settlement of $16.7 billion for misleading investors about the quality of loans it sold

Tony West, the associate attorney general, explained: “It’s kind of like going to your neighborhood grocery store to buy milk advertised as fresh, only to discover that store employees knew the milk you were buying had been left out on the loading dock, unrefrigerated, the entire day before, yet they never told you.

“And just like you might be in for an unpleasant surprise when you got home and poured yourself that glass of milk, investors – such as public pension funds and federally-insured financial institutions – were unpleasantly met with billions of dollars in losses when those securities investments soured.”

Brian Moynihan, Bank of America’s CEO, said: “We believe this settlement, which resolves significant remaining mortgage-related exposures, is in the best interests of our shareholders, and allows us to continue to focus on the future.”

On Wall Street, shares in Bank of America opened 1.5% higher on relief that a major cloud hanging over the firm had been removed.

Previously, the largest banking fine by US regulators was a $13 billion settlement reached with JPMorgan in 2013, for misleading investors during the housing crisis.

The Bank of America fine is the latest in a line of penalties imposed by the US on banks since the 2008 financial crisis.

In March 2014, Bank of America agreed to pay $9.5 billion to settle charges that it misled US mortgage lenders Fannie Mae and Freddie Mac over mortgage securities.

[youtube 3mv3m5rKtBI 650]

Bank of America has reported a 43% drop in its quarterly profits after a fall in mortgage revenue and a rise in legal costs.

The US’s second largest bank said net income of $2.3 billion in Q2 2014 was down from $3.4 billion a year earlier.

Its finances have been hit recently by huge payments to the authorities to fend off accusations of wrong-doing.

Bank of America has reported a 43 percent drop in its quarterly profits after a fall in mortgage revenue and a rise in legal costs

In 2013, Bank of America’s shares have fallen from 32 cents to 19 cents per share.

In April the bank agreed to pay $9.5 billion for misleading US mortgage lenders Fannie Mae and Freddie Mac before the financial crisis in 2008.

It then agreed separately to pay $783 million in fines and refunds, for mis-selling payment and identity theft insurance to nearly three million credit card customers.

Bank of America’s chief financial officer Bruce Thompson acknowledged the rise in litigation costs and praised the bank for doing “a good job managing expenses”.

Bruce Thompson also said that during the quarter the bank’s credit losses remained “near historical lows”.

Bank of America’s results come as analysts have noted a split in the US lenders’ quarterly results between banks that cater mainly to US customers and those with a more prominent global presence.

[youtube I8V93u9JPYc 650]

The US government is seeking $864 million in compensation from Bank of America for losses over home loans sold to it by the bank’s Countrywide Financial unit.

US attorney Preet Bharara made the request in documents filed late Friday in New York.

Bank of America was found liable for defrauding two US state-backed mortgage companies by a federal jury last month.

Countrywide Financial was acquired by Bank of America in 2008.

The ruling was a major win for the US government, which launched the case in the wake of the financial crisis.

Reports last month suggested that US banking giant JP Morgan is set for a record $13 billion fine to settle investigations into its mortgage-backed securities.

The US government is seeking $864 million in compensation from Bank of America for losses over home loans sold to it by the bank’s Countrywide Financial unit

Wells Fargo agreed to pay $335 million to settle claims it misled investors over mortgage-backed bonds.

The US Department of Justice is investigating at least nine banks over their sales of mortgage-backed securities.

Countrywide Financial was found liable for selling thousands of defective loans to Fannie Mae and Freddie Mac.

The month-long trial focused on a Countrywide programme that was internally called “Hustle” or “high-speed swim lane” which allowed loans to be processed quickly without checking their quality.

The wrongdoing, which mostly took place before Countrywide was acquired, was discovered after a whistleblower filed a lawsuit against the firm.

The US economy witnessed a big boom in its housing market in the lead-up to the 2007-08 global financial crisis.

As house prices continued to rise, many banks looked to cash in on the boom by creating complex financial products that grouped together home loans.

However, a collapse in the housing market saw the value of those investments plummet as the underlying mortgage holders became unable to repay their debts.

This snowballed into the subprime crisis, which hurt investors globally and caused billions of dollars in losses.

[youtube FTh996Jxg1I 650]

Citigroup has agreed to pay $395 million to Freddie Mac to settle claims of potential flaws in mortgages it sold to the firm.

The sum covers nearly 3.7 million loans sold to Freddie Mac between 2000 and 2012.

It is latest in a series of settlements by US banks with agencies Freddie Mac and Fannie Mae – bailed out by the government during the financial crisis.

The two have claimed that banks sold them toxic debts and as a result should be responsible for the losses on them.

“Today’s agreement with Freddie Mac marks another important milestone in successfully resolving Citi’s remaining legacy mortgage issues,” Jane Fraser, chief executive of CitiMortgage, said in a statement.

Tom Fitzgerald, spokesman for Freddie Mac said the agreement was an “equitable one” and “allows both companies to move forward”.

Citigroup has agreed to pay $395 million to Freddie Mac to settle claims of potential flaws in mortgages it sold to the firm

In the run-up to the financial crisis of 2007-08, the US witnessed a big boom in its housing market.

The boom saw banks grouping together home loans and selling them as investments, including to firms such as Freddie Mac and Fannie Mae.

But as the housing market collapsed and financial crisis spread many of the underlying mortgage holders were unable to repay their debts.

As a result, the investments plummeted in value, with disastrous consequences for banks all over the world.

Freddie Mac and Fannie Mae lost more than $30 billion, partly because of their investments in the subprime mortgages, and had to be bailed out by the US government.

Since then, banks have been under pressure to resolve claims on potentially faulty mortgages sold to the two firms.

Citigroup announced a deal in July to pay Fannie Mae $968 million for loans over a similar period.

In January, Bank of America agreed to pay Fannie Mae $11.6 billion to settle claims relating to residential home loans.

Bank of America has reported a sharp rise in profits for the first quarter of 2013 after it shed costs and set aside less money for bad loans.

Bank of America reported a net income of $2.3 billion in Q1 2013, after making $328 million in the last year’s same quarter.

Over the year the company has taken costs of $1 billion out of the bank, helped by 16,000 job cuts.

Also helping was a fall in the amount the bank set aside for bad debts – provisions were $1.7 billion, about a third lower than last year’s figure.

Bank of America is the latest US bank to report higher first quarter profits, with some having made record earnings.

Investment banking helped JP Morgan and Goldman Sachs, while Citigroup and JP Morgan, in common with Bank of America, both cut loan reserves.

Cost cutting was another common theme among the big banks.

Bank of America has reported a sharp rise in profits for the first quarter of 2013 after it shed costs and set aside less money for bad loans

Bank of America itself plans to have lowered costs by $8 billion by 2015, and it said another $1.5 billion of cost cuts would be in place by the end of 2013.

Leaving the one-off gains aside, Bank of America’s income from mortgages and income from trading in the fixed income, currency and commodities markets were both lower.

The weaker underlying performance sent the company’s shares lower on Wednesday, ending down 4.7%.

The bank’s chief executive, Brian Moynihan, said he was pleased with its performance: “Our strategy of connecting our customers to all we can do for them is working.”

Bank of America, along with two of its big four rivals, also pointed to income from investment banking as a positive contribution to earnings.

Brian Moynihan added: “Solid increases in loan growth to small businesses and middle-market companies, four straight quarters of steady growth in mortgage originations, record earnings in wealth management, and another quarter near the top in investment banking fees show we are balanced, focused and moving forward.”

[youtube zqHw4OWuyo8]

Bank of America has agreed to pay US government mortgage agency Fannie Mae $3.6 billion to settle claims relating to residential home loans.

In addition, Bank of America has agreed to buy back 30,000 mortgages for $6.75 billion, and pay a further $1.3 billion in compensation.

Fannie Mae argued the bank sold it toxic debts and should be responsible for the losses it suffered as result.

Separately, ten big mortgage providers agreed to pay $8.5 billion in compensation for mistakes in repossessing homes.

The banks include Bank of America, Citigroup, JP Morgan and Wells Fargo. They will pay $3.3 billion directly to homeowners, some of whom should not have lost their homes, regulators said.

Individual owners will receive anything from a few hundred dollars to $125,000.

Loan assistance and write-offs will make up the remaining $5.2 billion.

Fannie Mae supports the US mortgage market, which collapsed in 2008 after the housing bubble burst.

In the run-up to the financial crisis of 2007-8, home loans grouped together and sold on as investments became increasingly popular.

When the underlying mortgage holders were unable to repay their debts, the investments plummeted in value, with disastrous consequences for banks all over the world.

Bank of America has agreed to pay US government mortgage agency Fannie Mae $3.6 billion to settle claims relating to residential home loans

Freddie Mac is the other government mortgage agency. The two firms lost more than $30 billion, partly because of their investments in the subprime mortgages, and were bailed out by the US government.

Since the rescues, US taxpayers have spent more than $140 billion to keep the firms afloat.

Bank of America settled with Freddie Mac in 2011.

The agreement brings to an end a long-running dispute between Fannie Mae and Bank of America.

“A favorable resolution of this long-standing dispute between Fannie Mae and Bank of America is in the best interest of taxpayers,” said Bradley Lerman at Fannie Mae.

The company said the loans “did not meet our standards at the time of origination, and we are pleased to have reached an appropriate agreement to collect on these repurchase requests.”

The agreement covers loans worth about $1.4 trillion, with outstanding balances of $300 billion.

Bank of America said the settlements were “a significant step in resolving our remaining legacy mortgage issues”.

In October, the US government sued the bank for alleged mortgage fraud, accusing subsidiary Countrywide Financial of selling thousands of toxic home loans to Fannie Mae and Freddie Mac.

Earlier in the month, it took similar action against the banks Wells Fargo and JP Morgan Chase.

In October, JP Morgan was sued for allegedly defrauding investors who lost more than $20 billion on mortgage-backed securities sold by Bear Stearns.

JP Morgan, which bought the investment bank in March 2008, said the allegations related to actions at Bear Stearns prior to its takeover.

In the same month, Wells Fargo was also sued by federal authorities for alleged mortgage fraud.

Bank of America is being sued for $1 billion for an alleged mortgage fraud.

The civil lawsuit has been brought by the US Attorney Preet Bharara, the top federal prosecutor in Manhattan, New York.

Preet Bharara accuses Countrywide Financial, which Bank of America bought in 2008, of selling thousands of toxic home loans to Fannie Mae and Freddie Mac.

Fannie Mae and Freddie Mac are government agencies that support the US mortgage market.

Bank of America has yet to comment.

Countrywide is accused of running a trading scheme from 2007 to 2009 that was deliberately designed to process loans at high speed without checks on their quality.

The legal action against Bank of America follows similar moves by the US government earlier this month against Wells Fargo and JP Morgan Chase.

On October 2nd, JP Morgan was sued for allegedly defrauding investors who lost more than $20 billion on mortgage-backed securities sold by Bear Stearns.

JP Morgan, which bought the investment bank in March 2008, said the allegations related to actions at Bear Stearns prior to its takeover.

Meanwhile, on 10 October, Wells Fargo was also sued by federal authorities for alleged mortgage fraud.

The US government alleges that Wells Fargo lied about the quality of mortgages it handled, leading to huge losses for the Federal Housing Administration.

Wells Fargo has denied the allegations.

Credit ratings agency Moody’s has decided to downgrade 15 global banks and financial institutions.

In the US, Bank of America and Citigroup were among those marked down.

The UK banks downgraded were Royal Bank of Scotland, Barclays and HSBC. Lloyds also had its rating cut by Moody’s in a separate announcement.

The other institutions that have been downgraded are Goldman Sachs, Morgan Stanley, JP Morgan Chase, Credit Suisse, UBS, BNP Paribas, Credit Agricole, Societe Generale, Deutsche Bank and Royal Bank of Canada.

Moody’s added that it was putting some of the banks on a negative outlook, which is a warning that they could be downgraded again in the future.

Explaining this, it said governments around the world had shown a “clear intent” to reduce their support for banks going forward.

Credit ratings agency Moody's has decided to downgrade 15 global banks and financial institutions

In Friday trading, shares in Royal Bank of Scotland (RBS) were up 0.8%, HSBC had gained 0.6%, and Barclays had risen 0.5%. Lloyds was 1.6% higher.

In France and Germany, Societe Generale was up 2.1%, while shares in Deutsche Bank were flat.

In a statement, RBS responded to its downgrade saying: “The group disagrees with Moody’s ratings change, which the group feels is backward-looking and does not give adequate credit for the substantial improvements the group has made to its balance sheet, funding and risk profile.”

RBS estimated that the downgrade could mean it would need to find an extra £9bn in collateral for its debts.

Lloyds said it believed that the change would have “limited impact on our funding costs and market capacity”.

In the US, Citigroup said it “strongly disagrees” with Moody’s decision.

Of the banks downgraded, four were cut by one notch on Moody’s ranking scale, including HSBC, Royal Bank of Scotland, and also Lloyds.

A further 10 banks had their rating reduced by two notches, including Barclays. Credit Suisse was lowered by three notches.

Moody’s separates the 15 banks into three groupings, relative to its assessment of their resilience to any global financial market turmoil.

It puts HSBC in its strongest “first group”, together with Royal Bank of Canada and JP Morgan.

Moody’s says these banks have “stronger buffers” than many of their peers, and “generally more stable businesses”.

Barclays is in its “second group” of banks which Moody’s says faces “sometimes adverse factors”. Other banks at this level are BNP Paribas and Goldman Sachs.

RBS is in the bottom “third group”, which comprises banks which “have been affected by problems in risk management, or have a history of high volatility”. Other banks in this grouping include Bank of America and Citigroup.